Trusted Licensed Moneylender

in Singapore | Legal & Reliable

Welcome to Sumo Credit

Your Trusted Moneylender in Singapore.

Are you in need of financial assistance from a legal moneylender? Look no further! Sumo Credit is your trusted gateway to secure monetary solutions in Singapore. We offer reliable, fair, and transparent loan solutions tailored to your needs.

Your No.1

Licensed Online Moneylender

in Singapore

We pride ourselves on being one of the go-to online 24-hour moneylenders in Singapore thanks to our flexibility in letting borrowers complete loan applications online, anytime, anywhere round the clock.

As a licensed 24-hour moneylender online, our applications can be done easily through a straightforward online application form. Enjoy the ease of convenience in your very home. Rest assured knowing that loan approval, a simple face-to-face verification and cash disbursement will be done in a jiffy for we are a fast moneylender.

On top of our fuss-free online loan application process, we’ve amassed years of experience in helping borrowers from different backgrounds navigate life’s twists and turns, making us one of the most reliable moneylenders in Singapore.

Experienced and dedicated, we’re a legal moneylender in Singapore with loan solutions specially crafted for helping businesses and individuals alike — we’re thrilled to be part of your journey towards financial freedom.

*Disclaimer on being a 24-hour moneylender in Singapore: Our online loan applications are available 24/7. However, take note that you are required to visit our office for quick identity and document verification.

As seen on

Why Choose Us as Your Licensed Moneylender in Singapore?

Competitive Interest Rates

Our monthly interest rate is a competitive 3.92%, ensuring fair and affordable terms for your loan.

Flexible Loan Options

Whether you require a quick fix with a payday loan or prefer the convenience of spreading out your repayments with a monthly instalment loan, we’ve got you covered.

Generous Loan Amounts

Borrow up to 6 times your monthly income with a legitimate moneylender like Sumo Credit, providing the financial flexibility you need.

Accessible to All

All applicants with a fixed or non-fixed weekly or monthly income can apply!

Instant Approval

We’re known for being a quick moneylender in Serangoon; experience the convenience of instant approval within just 15 minutes of submitting your application.

Cash on the Spot

As a fast moneylender, enjoy speedy loan approval and receive cash on the spot for immediate access to your funds.

Foreigner-Friendly

Foreigners residing in Singapore are eligible to apply for our loans.

14 Years of Experience

With 14 years of expert licensed moneylender experience in Serangoon till date, Sumo Credit is your trusted partner for financial solutions.

Reviews of Our Moneylending Service from Satisfied Customers

Our Loan Services as a Dedicated Legal Moneylender in Serangoon

Benefits of Borrowing From Licensed Moneylenders in Singapore?

Authorised Moneylending Businesses

Did you know legal moneylenders are authorised by the Ministry of Law’s Registry of Moneylenders to conduct moneylending businesses?

All private moneylenders have to hold valid licences in order to operate their moneylending businesses. Just so you know, moneylenders’ licences have to be renewed yearly.

Low Credit Score-Friendly

Licensed moneylenders are private moneylenders in Singapore that extend loans to borrowers even if they do not have the best credit scores.

Traditional banks are very stringent in this respect, making legal moneylenders in Singapore a great alternative for loans.

Interest Rate & Fee Caps

Authorised moneylenders in Singapore are 100% legal and bound by the law when it comes to the interest rates and fees they can charge, so you can rest assured that you will never be ripped off.

According to the regulations, legalised moneylenders in Singapore are only allowed to charge an interest rate or late interest rate of up to 4% monthly, impose an administrative charge of up to 10% of the loan principal, and levy a late fee of $60 and below for each month of late repayment.

Wide Range of Loans

Legal moneylenders in Singapore provide a huge array of loans to suit borrowers’ diverse needs, including but not limited to personal loans, business loans, debt consolidation loans, renovation loans, wedding loans, medical loans, private hire loans, business loans, etc.

Flexible Loan Tenures & Repayment Schedules

Reliable moneylenders in Singapore understand the need to offer their clients flexible loan tenures and repayment schedules as everybody’s circumstances are different.

Most legalised moneylenders in Singapore offer loan tenures ranging from 3 to 12 months, with a monthly repayment schedule. Some licensed moneylenders are open to bi-weekly repayments, while others may offer loan tenures as long as 24 months on a case-by-case basis.

If you’re looking for an urgent cash advance to tide through an emergency before your salary comes in, take heart that licensed moneylenders in Serangoon and beyond also offer payday loans where you’ll have to pay up in full —including interest incurred— on your next payday.

Clear Explanation of Loan Terms & Conditions

While we’re recognised as an online licensed moneylender, contract signing and verification have to be done in person at our moneylender office in Serangoon.

As a licensed moneylender in Singapore, we are also obliged to run through your loan contract’s terms and conditions with you, to answer any questions you may have regarding the loan contract, or even let you negotiate your loan amount and repayment due dates.

All of these have to be done in a language that you understand fully so you can make an informed decision and are fully aware of what the loan entails in entirety, e.g. interest rate, late fees, charges, repayment schedule, what happens if you default on the loan, etc.

Easy Eligibility Criteria

On top of being quick moneylenders that offer ultra speedy loan approvals, private moneylenders in Singapore have extremely easy loan eligibility criteria that almost anyone and everyone can fulfil to get the loan they need — there is no minimum income requirement at all.

The key thing that legal moneylenders look for is borrowers’ ability to repay the loan, and this usually just means having a consistent source of income.

Streamlined Application Process

Bid farewell to lengthy approvals! moneylenders in Singapore like Sumo Credit offer quick access to funds for personal or business needs.

Applying with a licensed moneylender online has never been easier with online loan applications on our website that make the application process many times easier, and speedier.

Your loan application will be finalised after a simple in-person verification with our friendly loan consultant. With prompt approvals, you can address financial needs without delay.

Transparent Communication

Reliable moneylenders in Singapore like Sumo Credit prioritise clear communication with all borrowers all things related to the loan, thereby empowering borrowers with the ability to make carefully considered decisions with no hidden charges or ambiguity.

Speedy Loan Disbursement

Borrowing from licensed moneylenders has never been easier. Instant moneylenders like Sumo Credit offer swift loan approval and disbursement. Once the loan contract has been signed, you can expect to get your loan disbursed instantly in cash or via bank transfer. The process is extremely speedy to say the least!

Respectful & Courteous At All Times

Licensed moneylenders are to be respectful and courteous towards their (potential) customers at all times. This means not using threats, intimidation tactics, abusive language or any hint of pure rudeness when dealing with customers at any point of their loan journey with the local moneylender.

Your Trusted Financial Partner

Navigate the complex world of finance with confidence. As your trusted moneylender in Singapore, Sumo Credit offers guidance and support for your financial journey, catering to all borrowers new and old with utmost integrity.

Allowed to Operate Only Under Stringent Regulations

Licensed moneylenders in Singapore are expected to ensure compliance with strict regulations and laws pertaining to moneylending, all while providing peace of mind and access to tailored loan solutions.

Should any licensed moneylender be found to have breached any regulation, the Registry of Moneylenders can take the moneylender to task and suspend or revoke their moneylending licence at their discretion. Sometimes, fines are meted out as well.

FAQs on Legal Moneylenders in Singapore

Are licensed moneylenders in Singapore regulated?

Yes, all licensed moneylenders in Singapore are strictly regulated by the Registry of Moneylenders, under the umbrella of Singapore’s Ministry of Law.

Is it true that licensed moneylender loans are easy to qualify for?

Of course! Licensed moneylenders have straightforward eligibility criteria. To qualify, you need to be of legal age, remain gainfully employed, and have a consistent income.

Can I get my loan on the same day?

Yes, many borrowers are able to obtain their cash sum on the same day of loan application if everything is in order, including all required documentation.

Do licensed moneylenders provide tailored loan packages for various needs?

Yes, licensed moneylenders in Singapore offer various loan options such as personal loans, payday loans, business loans, fast loans, and bad credit loans. Loan packages can be customised to suit individual needs.

How much can I borrow from licensed moneylenders in Singapore?

There is no limit to how much you can borrow from registered moneylenders if you’re talking about secured loans, where collateral (e.g. your home or car) has to be pledged. As for unsecured loans, the maximum you can borrow across all licensed moneylenders in Singapore at any one time is as follows:

Singaporean/Permanent Resident

- $3000 if your annual salary is (i) less than $10,000 or (ii) at least $10,000 but less than $20,000

- 6 times your monthly salary if your annual salary is at least $20,000

Foreigner living & working in Singapore

- $500 if your annual salary is less than $10,000

- $3000 if your annual salary is at least $10,000 but less than $20,000

- 6 times your monthly salary if your annual salary is at least $20,000

Can I get a legal moneylender loan if I’m a freelancer or gig worker?

Yes, you can get a moneylender loan even if you’re a freelancer or gig worker. The most important thing is you must be earning an income regularly and be able to show proof of that.

Can I borrow from a moneylender if I’m a foreigner?

Absolutely. Many licensed moneylenders in Singapore offer loans to foreigners living and working in Singapore.

Can I borrow from multiple moneylenders?

Yes, you can borrow from multiple moneylenders provided you haven’t exceeded the loan cap imposed by the Registry of Moneylenders. When it comes to taking multiple loans from registered moneylenders, definitely give it some serious thought — you have to be confident in your ability to repay your monthly instalments punctually!

Are legal moneylender loans flexible?

Yes, legal moneylenders offer great flexibility when it comes to loan tenures and repayment schedules. Feel free to discuss your needs with your licensed moneylender.

Is a licensed moneylender a safe option in Singapore?

Absolutely. Licensed moneylenders are legal loan providers authorised by the Registry of Moneylenders. They are a safe, alternative option for those who are unable to obtain loans from traditional banks and financial institutions. Do not mix these legal moneylenders up with illegal lenders like Ah Longs.

Are licensed moneylenders transparent in their dealings?

Yes, all legal moneylenders in Singapore are expected to be fully transparent with borrowers new and old. This means no hidden fees and charges, clearly communicated loan terms and conditions, etc.

Do legal moneylenders allow online loan applications?

Not all legal moneylenders have online loan application capabilities. That being said, you can send in your online loan application anytime you’re ready with us. Simply fill out a form!

Must I meet my licensed moneylender?

Yes, it is mandatory that you meet your licensed moneylender in person at their office.

Do licensed moneylenders do credit assessments?

Yes, all legal moneylenders in Singapore have to do simple credit assessments to determine a borrower’s suitability in getting a loan. For this, the moneylender will refer to the borrower’s Loan Information Report.

Must my licensed moneylender explain all loan terms?

Yes, your licensed moneylender must explain all loan terms to you clearly and ensure you fully understand. They are obliged to do so in a language that you understand.

Can I get a legal moneylender loan despite my bad credit score?

Most certainly. Legal moneylenders are happy to provide loan solutions to anyone and everyone, including people who have bad credit scores.

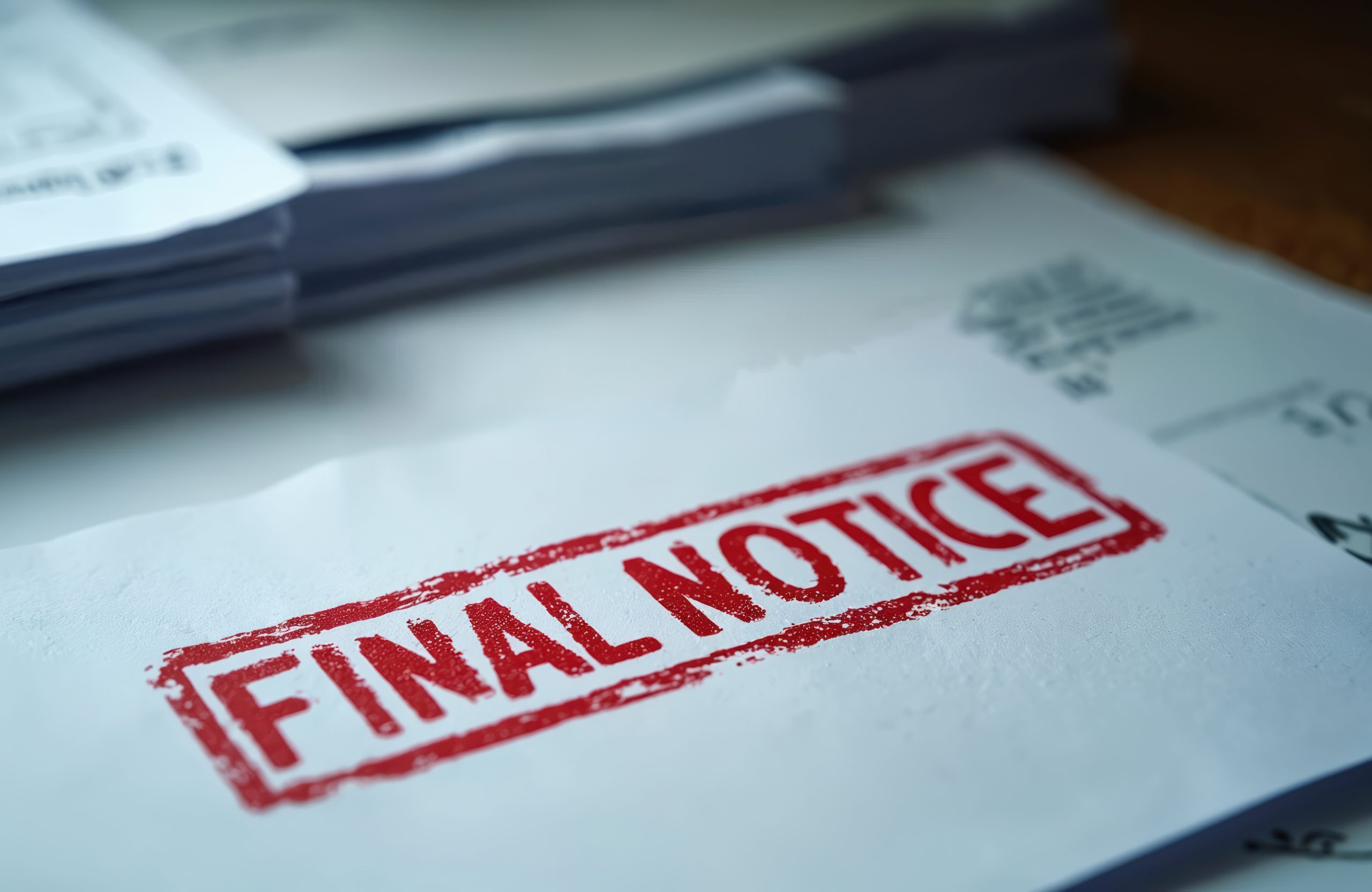

What happens if I’m unable to pay my moneylender in Singapore?

Several things can happen if you are unable to pay your moneylender:

-

You’ll incur late interest charges and compound interest charges on sums owed

-

You’ll incur late payment fees for each month of skipped or late payments

What can licensed moneylenders do to recover debts?

Licensed moneylenders are permitted to take the following actions in the name of recovering what borrowers owe:

-

Your moneylender can call you or send you messages to remind you about making repayments at reasonable times of day

-

Your moneylender can send you a Letter of Demand by mail, issue it in person at your residential address or workplace (last resort)

-

Your moneylender can appoint a debt collector to collect debts from you

-

Your moneylender can take legal action against you for the purpose of recovering loans

What is the interest rate charged by private moneylenders in Singapore?

Most private moneylenders in Singapore charge an interest rate of 1 – 4% monthly for unsecured loans. The maximum they are permitted to charge is 4% monthly, and this applies to late interest rates, too.

What is the admin fee charged by an authorised moneylender in Singapore?

Authorised moneylenders in Singapore are allowed to charge an admin fee of up to 10% of the loan principal. It is common for the admin fee to range from around 8-10%.

Can licensed moneylenders charge an admin fee to kickstart the loan process?

No, the admin fee can only be charged at the point when the loan is being granted, not before. Take note the admin fee will be deducted from your approved loan amount, so don’t be alarmed when the loan disbursed falls short of your approved loan sum!

What fees and charges can private moneylenders charge?

Licensed moneylenders can charge interest, late interest, a one-time admin fee, and late repayment fees (where applicable) up to the limits set by regulations. However, the total interest, late interest, admin fee and late repayment fees cannot be more than the loan principal amount.

Are licensed moneylenders allowed to advertise?

Licensed moneylenders can advertise; however, they can only advertise through three main channels:

-

Consumer or business directories

-

The moneylender’s website(s)

-

Advertisements inside or on the outside of the moneylender’s office

Can licensed moneylenders take borrowers to court?

Yes, licensed moneylenders can take borrowers to court if need be. Extending from that, licensed moneylenders who take legal action against borrowers to recover their loans can bill borrowers all court-ordered legal costs if their claims are successful.

How can I verify if my private moneylender is licensed?

You can look up the official list of licensed moneylenders on the Registry of Moneylenders’ website and check if your private moneylender is listed. In case you’re wondering, the list is regularly updated.

For double assurance, make sure to visit the local moneylender’s office and ask to see their moneylending licence — their office address, landline number and licence number should all tally with the information found in the Registry of Moneylenders’ list.

How do I settle licensed moneylender disputes?

You have several options when it comes to settling licensed moneylender disputes. But first, always try to talk things out amicably with your moneylender to see if a new repayment plan that’s more feasible for your current situation can be agreed upon.

Otherwise, you can consider contacting social service organisations for assistance or, as a last resort, file for bankruptcy.

What is the difference between a bank loan and a private moneylender loan in Singapore?

The main differences between a bank loan and a private moneylender loan are:

- Banks have much tougher eligibility requirements

- Banks focus greatly on borrowers’ credit score and credit history

- Banks have relatively lower interest rates

- Banks have longer tenures

That being said, not everybody can qualify for bank loans. In times of need and emergencies, licensed moneylenders are a legal and safe alternative to consider.

What are the differences between a licensed and unlicensed moneylender?

It is legal to borrow money from a licensed moneylender, but not from an unlicensed lender. Borrowing from an unlicensed lender is fraught with risks and lacks legal protection.

For example, unlicensed lenders tend to charge exorbitant interest rates and fees to unsuspecting borrowers. They don’t offer loan contracts and typically resort to violence and harassment when recovering debts. Many unlicensed lenders are also very exploitative and aggressive.

Never ever borrow from illegal moneylenders, for they are dangerous and unscrupulous — you could be putting your family and your safety at risk!